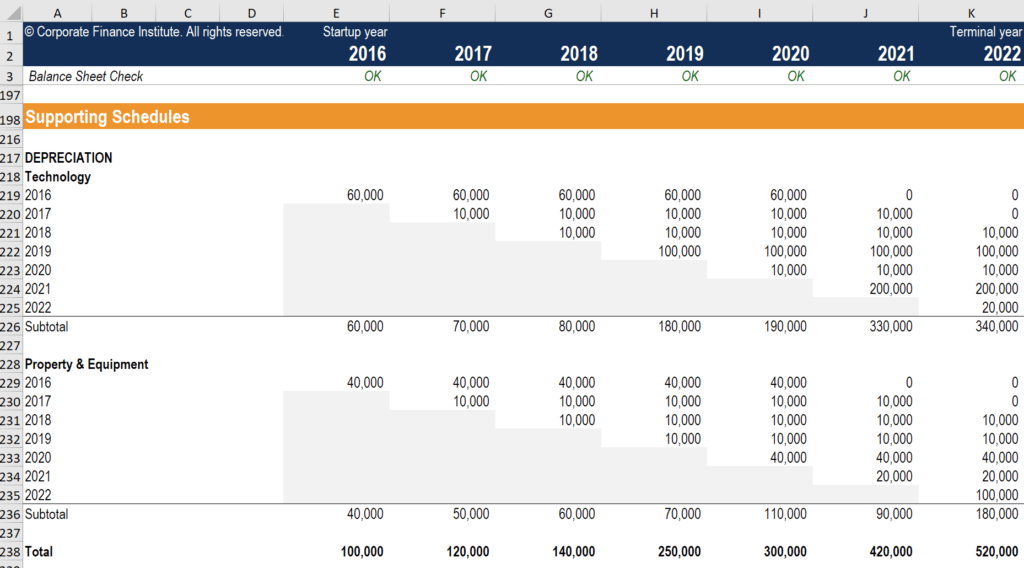

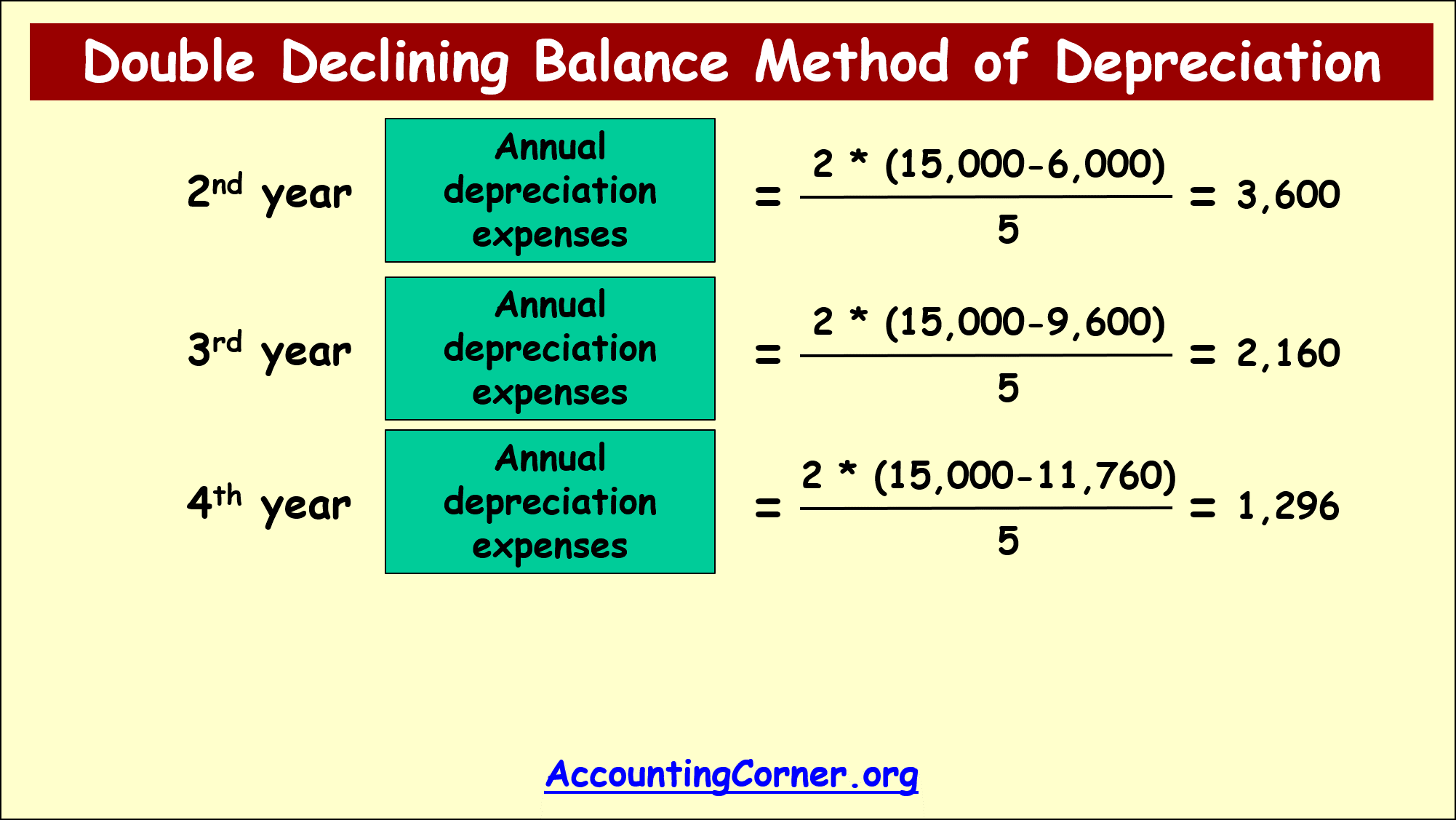

Bonus Depreciation 2024 Rules In Hindi. Bonus depreciation is an accelerated form of depreciation — it allows you to deduct a fixed percentage (80% for 2023) of an asset’s cost upfront instead of spreading. It allows a business to write off more of the cost of an asset in the year the company starts using it.

These two rules expand the ability of taxpayers to treat used property as eligible for bonus depreciation, while reducing the potential tracking burden that would. Overview of bonus depreciation in 2024.

Bonus Depreciation 2024 Rules In Hindi Images References :

Source: allixyclarisse.pages.dev

Source: allixyclarisse.pages.dev

2024 Bonus Depreciation Rate In Hindi Dani Millie, To be eligible, a used asset must be new to the taxpayer.

Source: aleciayceciley.pages.dev

Source: aleciayceciley.pages.dev

Is Bonus Depreciation Allowed In 2024 Loria Robbin, 179 and bonus depreciation deductions for qualifying assets.

Source: allixyclarisse.pages.dev

Source: allixyclarisse.pages.dev

2024 Bonus Depreciation Rate In Hindi Dani Millie, This tax alert will focus on three major provisions of the final legislation:

Source: gretnaqhendrika.pages.dev

Source: gretnaqhendrika.pages.dev

2024 Bonus Depreciation Celka Darlene, Bonus depreciation is a way to accelerate depreciation.

Source: selaazquentin.pages.dev

Source: selaazquentin.pages.dev

Bonus Depreciation 2024 Rules And Regulations Ibbie Arabella, This guide offers a detailed look into the mechanics and strategic application of bonus depreciation in 2024, particularly focusing on new developments and how businesses.

Source: arlyykrista.pages.dev

Source: arlyykrista.pages.dev

Bonus Depreciation 2024 Vehicles In Hindi Drucy Giralda, Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production of income, the additional first.

Source: shoshannawanni.pages.dev

Source: shoshannawanni.pages.dev

Bonus Depreciation Bill 2024 Inge Carolyne, Overview of bonus depreciation in 2024.

Source: allixyclarisse.pages.dev

Source: allixyclarisse.pages.dev

2024 Bonus Depreciation Rate In Hindi Dani Millie, Claiming bonus depreciation on qip placed in service in 2018, 2019, or 2020.

Source: claudeazgarnette.pages.dev

Source: claudeazgarnette.pages.dev

Bonus Depreciation 2024 Rules Aura Sharla, 179 and bonus depreciation deductions for qualifying assets.

Source: joniypierrette.pages.dev

Source: joniypierrette.pages.dev

Bonus Depreciation 2024 Rules Orel Martina, This guide offers a detailed look into the mechanics and strategic application of bonus depreciation in 2024, particularly focusing on new developments and how businesses.

Category: 2024